excise tax malden ma

The excise tax rate is 25 per 1000 of assessed value. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287.

Great Barrington Tax Reforms Residential Exemption Split Rate Could Benefit Most Homeowners The Berkshire Edge

Massachusetts State law allows motor vehicle excise tax exemptions for vehicles owned by certain disabled people and veterans former prisoners of war and their surviving spouses and charitable organizations.

. Massachusetts Property and Excise Taxes. The excise is levied annually in lieu of a tangible personal property tax. 50 for a Residential Certificate.

See reviews photos directions phone numbers and more for Excise Tax locations in Malden MA. Name A - Z Sponsored Links. City of Malden.

City Of Lawrence Excise Tax in Malden MA. Chapter 60A of the Massachusetts General Laws imposes an excise on the privilege of registering a motor vehicle or a trailer in the Commonwealth of Massachusetts. Excise has been paid complete this form and provide the specified documentation.

Ethan Sawyer Tax Services. Search results for Motor Vehicle Excise in Malden MA YEAR NUMBER NAME DESCRIPTION AMOUNT TO PAY Enter the required information above. Non-registered vehicles however remain subject to taxation as personal property.

You need to pay the bill within 30 days of the date we issued the bill. 100 for a Commercial Certificate. You will be notified by mail of a.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. All payments made after 1000 PM EST will be credited the next business day. If your vehicle isnt registered youll have to pay personal property taxes on it.

If your vehicle is registered in Massachusetts but garaged outside of Massachusetts the Commissioner of. Its free to pay watersewer real estate personal property and motor vehicle excise taxes online with e-check. Abatement applications must be received by the assessors within three years after the excise was due or one year after the excise was paid whichever is later.

It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. About City of Malden. After you do business with City of Malden please leave a review to help other people and improve hubbiz.

If you are unable to find your bill try searching by bill type. Canton is on a quarterly billing cycle for real estate and personal property taxes. The excise rate is 25 per 1000 of your vehicles value.

The DUE and BALANCE amounts may include additional interest and late fees. Date of Birth. You pay an excise instead of a personal property tax.

Payment 1 - August 1st. We send you a bill in the mail. Payment 4 - May 1st.

781-397-7000 City Hall Hours. To preserve your right to appeal you must file on time. Motor Vehicle Excise Tax.

Pay Delinquent Excise. 781-397-7000 City Hall Hours. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

However service fees do apply for payments made with a credit card. Malden MA 02148. Taxes-Consultants Representatives Tax Return Preparation Accountants-Certified Public.

To preserve your right to appeal you must file on time. The due dates are. Payment 3 - February 1st.

Pay Excise Taxes in Malden MA. When you give Liberty Tax the honor of preparing your taxes youre choosing to work with dedicated tax professionals wholl help get you every deduction youre. City of Malden.

YEARS IN BUSINESS 781 477-4272. By law assessors may only. Real estate taxes are billed quarterly.

Malden MA 02148. Tax Return Preparation Attorneys. Payment 2 - November 1st.

However service fees do apply for payments made with a credit card. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. YEARS IN BUSINESS 617 292-9220.

Tax information for income tax purposes must be requested in writing. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown. City of Malden - Treasurer - Excise Tax is located at 77 Salem St in Malden MA - Middlesex County and is a business listed in the categories City County Government Government Offices City Village Borough Township and Government Offices Local.

101 Tremont St Ste 800. Name A - Z Sponsored Links. Fees Municipal Lien Certificates.

City of Malden. By law assessors may only. Find your bill using your license number and date of birth.

355 East Central Street Franklin MA 02038. Malden MA 02148. Drivers License Number Do not enter vehicle plate numbers spaces or dashes.

Thirteen Things To Know About R I S 13 6 Billion State Budget The Boston Globe

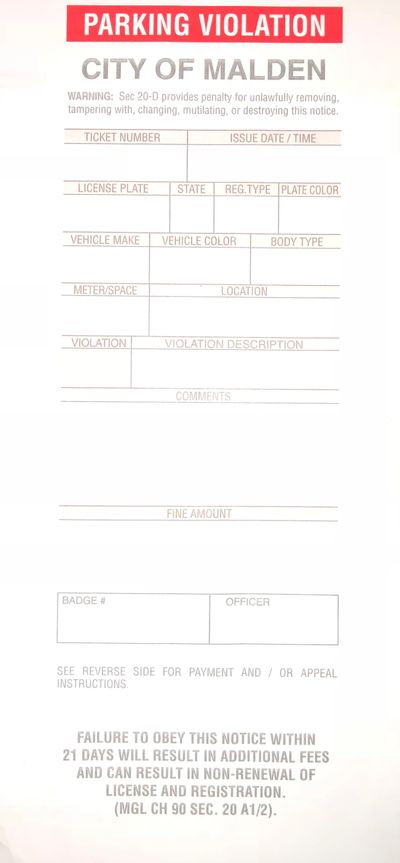

Resident Sticker Parking Program Outlined At Public Hearing Malden Ma Patch

Everett On The Rise Blog Transportation Latest News

Lowell City Hall And Downtown Aerial View In Downtown Lowell Massachusetts Usa Stock Photo Alamy

Fiscal Year 2021 Proposed Budget Malden Ma

The State Management Of Media Activities In Vietnam Nguyen The Russian Journal Of Vietnamese Studies

Baker Under Pressure To Put Brakes On Gas Tax News Gloucestertimes Com

Form 5330 Everything You Need To Know Dwc

/cdn.vox-cdn.com/uploads/chorus_asset/file/19915691/93151637_2771087436293879_2468457111059693568_n.jpg)

Massachusetts Distillers Petition State To Deliver During Pandemic Eater Boston

How To Pay Your Motor Vehicle Excise Tax Boston Gov